The FED has also stated it will take action to keep interest rates low.

Can the FED have 2% inflation and low rates?

Can it do so without bankrupting the US government?

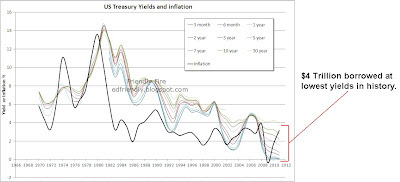

The chart below shows the yield on treasury bonds versus inflation. Notice how most of the time the yields on bonds trade above the inflation rate. Notice also that yields on treasuries are at an all-time low over the last 40 years.

Bond investors will desire yields that, at the minimum, keep up with inflation. This means yields will have to go up to continue attracting bond investors.

What will rising yields do to the US government finances?

Below is a snapshot of US debt on 11/30/2006. The chart shows when all the marketable debt matures (marketable debt is debt the government owes to the public. This debt doesn’t include the money the government owes to other government agencies like the Social Security Administration). It also shows the effective interest rate for each maturity. The effective rate is the amount of interest the government will have to pay in the next year for each maturity group.

As of 11/30/2006 the US government was scheduled to pay $152 Billion in interest in the next 12 months. The interest payments represent 6.3% of the government’s 2006 revenue.

Below is the same snapshot of the US debt on 11/30/2010 – four years later. Notice how the large amount of borrowing the government did was short term bonds. Even though the government doubled their debt in four years the interest it was scheduled to pay in the next 12 months was only $199 Billion which is 9.2% of the government’s 2010 revenue. This is because the government borrowed short term and it borrowed at the lowest rates in history. In fact 51% of the debt at that time had a yield of less than 2%. In 2006 none of the debt had a yield below 2%.

The US government debt is like one giant adjustable rate mortgage. Although it borrowed very cheaply over the last few years, it is very sensitive to interest rate fluctuations since it will have to continually roll over expiring debt at the prevailing interest rate. It will have to roll this debt over frequently since most of its holdings are short term bonds. This is why the government is now more sensitive to interest rate fluctuations.

What if the government was making interest payments on its current debt with the effective rates it had in 2006? Interest payments would be $317 Billion which is 14.6% of government revenue. If rates head north of 4% the US government could easily be using 20% of its revenue to pay interest on debt.

Although Bernanke may desire 2% inflation, I’m not sure the government desires it or can afford it.

I'm also not sure how the FED is going target 2% inflation AND keep rates low. They seem to be conflicting goals.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.